Are you in need of a Fast and Affordable FEMA Elevation Certification Letter or Letter of Map Amendment (LOMA)?

If you live, or are considering moving to, areas where flooding may be a problem, then you may be in need of special land surveying or certification.

Before you have flood certification land surveys done on your land, consult the known information on flood plains in your area. This may be listed in your property profile, and if so, it can be obtained through the real estate agent. There are also FEMA flood maps which can be found on their website. In most cases, floodplains, which are expected to flood periodically, are described by the expected frequency, such as an annual floodplain or a 100-year floodplain. Even if your land is not in a designated flood plain, the plot of land still has a designated flood zone. This does not mean that the land is likely to flood. It is simply an area defined by a level of flood risk; even areas of low or almost nonexistent risk lie within a certain flood zone.

Whether your land is located in a flood plain is important not only because of the possibility of flooding, but also because mortgage companies may require you to secure flood insurance before they will finance your purchase. The FEMA site tells you whether flood insurance will be required if you plan to finance land that lies within the flood plain outlined on their maps.

The FEMA flood plain maps are known as Flood Insurance Rate Maps, or FIRM. Mortgage companies who you may contact to finance your real estate purchase are required by law to determine whether the plot of land lies in any floodplain that is expected to flood at least once per century. When the land in question does lie in such a flood plain, the mortgage company may require that you obtain flood insurance before they will finance the land, since the land has a substantial risk of flooding during the lifespan of a typical 30-year mortgage.

If your land lies in a 100-year or more frequent floodplain, it is also known as lying in a Special Flood Hazard Area, or SFHA for short. Instead of purchasing flood insurance, you can also apply for a Letter of Map Amendment (a LOMA) or a Letter of Map Revision (a LOMR) to show that your land or building is not actually in the flood plain. Only the LOMA or LOMR can remove the requirement for flood insurance. You may also need an Elevation Certificate, which applies to buildings constructed on elevated structures so that the buildings themselves are higher than the flood level. All of these require a land survey to give you as accurate of a picture of the land as possible. They are particularly useful if you have changed the elevation of the land significantly through grading or other activities, or have built up the land underneath a building so that the building no longer lies in the flood plain despite the fact that the area around it still does.

Never rely on anyone’s word that the land will be suitable for your purposes or that it won’t flood. A land survey can tell you the concrete details of the land you are interested in. Even if the property is located well inland, always investigate the possibility of flooding. Besides the fact that floods are rather inconvenient, it can also be expensive, both to repair flood damage and to pay for flood insurance so that you can finance the property. If your land does lie within these areas, you can either have a land survey done and apply for a LOMA or LOMR to revise the flood maps, or purchase flood insurance through the National Flood Insurance Program.

Which flood zone is the property is located in is very important

Zone “A”: Flood prone area, but no Base Flood Elevations determined by FEMA. (Zone “A” is an estimated approximation and can be larger than actual flood plain)

Zone “AE”: Flood prone area, Base Flood Elevations determined by FEMA. (Base Flood Elevations or “BFE” can only be determined by detailed engineering study)

Zone “X”: Areas outside of the 100 year (1% annual chance) flood plain.

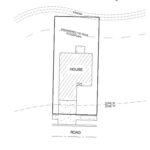

Part of the property is in Zone “A” or “AE”, house is in Zone “X”. Usually a simple elevation certificate can demonstrate that the house is in Zone “X” and the flood insurance requirement is waived. A Base Flood Elevation is not important. Some lenders may still require a LOMA just to “be on the safe side”, though this is largely unnecessary.

House in Zone “A” and inside the actual flood plain. Flood insurance will be required, the only thing to be determined is the premium amount. Although an Elevation Certificate will be required, the premium class will be highest risk without a valid BFE. An option is to obtain a private study to determine the BFE. Depending on the probable elevation relevance to the flood plain, the home-owner may save money by obtaining a private study.